Today, many people are looking into cryptocurrencies, and internal revenue is no exception. However, many investors buy and sell digital coins with no concern if it is being taxed or not. Many are less bothered if it is taxed, since they probably do not want to figure out how. As attractive as digital investments are seen, investors are known to panic at their declining stage.

Cryptocurrencies are highly volatile, in that no investor expects the same rate for an extended period. Hence, investors keep finding the most profitable blockchain while developers keep implementing new cryptocurrencies into the financial market. Cardano, as a newborn, is rapidly increasing despite the high competition of the crypto trades ahead. As people continue to buy Cardano, they realize the safety and faster rate of transaction. However, the question remains, is there a tax liability on coins, either directly or indirectly?

This article answers this question, alongside the more significant advantage of why investors should consider Cardano.

What is Cardano?

Cardano is a blockchain technology for ADA cryptocurrency. However, many people use the two terms interchangeably for convenience. It is a digital currency that can serve as a medium of exchange or daily transaction. Although, its purpose as an everyday transaction is not entirely accepted yet.

Many companies, small-sized and middle-sized businesses, do not accept it as a foreign exchange means yet. Recently, many people buy Cardano because of its ability to bounce back after the rapid fall in cryptocurrencies price in 2018.

The Cardano blockchain is encrypted and does not permit easy access to internet fraudsters. With Bitcoin being at the top ladder, Cardano has found itself among the top ten digital currencies.

Big and established companies, who use coins as a means of daily transactions, encourage millennials and Gen Z to take up the finance institution challenge.

Is Cardano taxable or Not?

Generally, cryptocurrency traders are taxed based on the Internal Revenue Service IRS rules. The rules followed the advancement of cryptocurrencies since they started appearing as a robust investment platform, like stocks and bonds. Then, it was required not to treat it as world currencies.

Firstly, it is good to be clear that cryptocurrencies are taxed when you purchase goods and services with your coin. The value of your currency would determine the capital gains taxes. Moreover, every asset is taxed, either it is virtual or physical. Since many investors are beginning to store cryptocurrencies as assets rather than trading them, it contributes to the implementation of IRS rules.

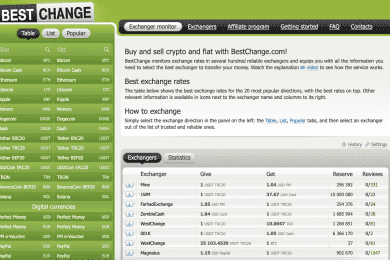

The IRS rule may not apply to Cardano in most cases because investors are not storing it up as they do Bitcoin. If you are looking into a blockchain to own a digital asset, Cardano is a good idea. It includes reduced tax amounts because lesser transactions are going on here compared to the leading cryptocurrencies. Also, the bridge between Cardano and Nervo allows investors to navigate their way between the two.

Cardano keeps implementing ways to provide maximum security, faster transaction rates at a reduced cost, and the bridge innovation is an answer to it. Instead of owning two wallets on different crypto platforms, you can link up the two together. Apart from reducing the transaction cost, it minimizes investors’ tax if they need to pay.

Here is how cryptocurrency taxation works.

If the value you are selling or spending your coins is larger than the amount you bought, it will incur crypto tax. However, if you are selling at a devalued amount, it incurs little or no crypto tax.

Another factor that influences the amount of tax to pay is the duration of hodling your coins. If you have held your currency for a long time, you can expect higher taxation. Hence, a coin on hodl for one year and above is considered a long-term capital gain. That is, it attracts extra income.

Conclusion

When you buy Cardano, you are likely exempted from the tax policy. So far, it is primarily applicable to the Bitcoin blockchain. Bitcoin is the most costly digital coin per unit and also has many influencers as investors. Hence, the hike in tax is understandable. Moreover, digital currencies’ success is majorly based on your expertise and observation of the market trend. Nevertheless, you can buy Cardano from a reputable trading platform like Bitvavo.com. The platform guarantees the maximum safety of your digital asset.

My name is Sardar Ayaz a professional content writer and SEO expert having Proven record of excellent writing demonstrated in a professional portfolio Impeccable grasp of the English language, including idioms and current trends in slang and expressions. I have ability to work independently with little or no daily supervision with strong interpersonal skills and willingness to communicate with clients, colleagues, and management.

I can produce well-researched content for publication online and in print, organize writing schedules to complete drafts of content or finished projects within deadlines. I have 12 years’ experience to develop related content for multiple platforms, such as websites, email marketing, product descriptions, videos, and blogs.

I use search engine optimization (SEO) strategies in writing to maximize the online visibility of a website in search results