Many startups have already bet on Blockchain technology to create innovative businesses.

Generally, there are several benefits Blockchain fundraising mechanisms offer over traditional methods that help handle and share funds safely. Such fundraisings as ICOs (Initial Coin Offerings) or STOs (Security Token Offerings) are commonly known. But some of you might be confused and not understand the essence of these two terms. This article will explain which type gives you, as an investor, more prospects and opportunities to succeed today.

What is STO or Security Token Offering?

Tokens are sold and issued via token sales or STOs, which grant the buyer (investor) a share in the issuing company’s assets.

An STO is a digital tool for financing companies or raising money for ideas and projects. Like ICOs (Initial Coin Offering), STOs are based on the idea of crowdfunding but work in a quite different way. Institutional as well as private investors may take part in STOs as a financing round for companies.

In contrast to ICO (Initial Coin Offering), the buyer and investor not only acquires a promise or a more or less clearly defined benefit via utility tokens, but STO also operates in some concrete way: security token purchased offers more security, can be compared to security, and is backed by an asset.

The additional security also comes from issuing Security Tokens, and thus the INX digital securities offering is much more regulated compared to ICOs and Utility Tokens.

Details on STOs

In essence, Security Token Offerings (STOs) are based on the principle of Initial Coin Offerings (ICOs) and follow the same or similar rules and processes as summarized here.

The main feature that differentiates STOs from ICOs lies in the type of tokens issued and thus in a higher level of security. In Security Token Offering, the investor acquires an asset that is comparable to security. This makes STOs, in some ways, the better and safer execution of ICOs. This is also because security tokens, and therefore STOs, are treated by lawmakers similarly, or the same as securities and are therefore much more strictly regulated.

What is ICO or Initial Coin Offering?

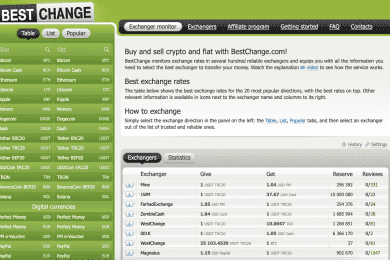

Initial Coin Offering is a variant of investment financing by the crowd. In ICO, companies offer their coins or tokens for sale. These tokens can be purchased against common cryptocurrencies, such as Bitcoin or Ethereum. A Blockchain, in most cases Ethereum, is used to process a purchase. By using the Blockchain, investors remain largely anonymous.

Initial Coin Offerings are (or rather: would be and were) by their very nature an excellent instrument for financing ideas, startups, and projects. Newly discovered gold veins and hypes also attract hazardous and light-shy riff-raff. Therefore, reputable providers have had to share this hype and thus the concrete instrument ICO with pirates, Wild West swashbucklers, soldiers of fortune, and bandits. In addition, there is a quota of well-meaning but clueless people who do not want to cheat but can never succeed with their business idea.

The worst thing that can happen to ICO

Fraudulent ICOs aren’t even the worst thing; they can be identified rather quickly with a little savvy and research. Worse is when well-meaning, blue-eyed fantasists with the idea that can never work meet investors whose greed completely clouds their brains, healthy caution, and any kind of restraint. Worse because a well-intentioned approach with a pointless project can lead to the same disaster as a has-been project. Only the former produces losers on both sides. And ICO instrument gets another unnecessary dent.

STO vs. ICO

Security Token Offerings are expected to more or less displace or even replace Initial Coin Offerings. This is mainly due to the hype and exaggerations surrounding ICOs.

The weak or even unregulated issuance of utility tokens in ICOs has led to numerous ICOs characterized by exaggerations and were sometimes conducted unseriously. Uncertain whitepapers, uncertain promises that could not be kept, and soldiers of fortune as providers have left frustrated or bruised investors and thus scorched earth.

That is why ICOs now have a somewhat dubious reputation. Partly unjustifiably, because the instrument itself can be a good financing tool if the protagonists work seriously.

Security Token Offerings (STOs) take good points of ICOs but replace issuance of (sometimes worthless) utility tokens with security tokens based on assets. This, and the stronger regulation that comes with it, makes STOs a financing tool that imposes clear rules on providers and promises investors more security.

STOs are, therefore, not just old wine in new bottles; they are the heavily modified form of ICOs carried out with significantly higher security. Thus, security token offerings have the potential to replace the (too often) abused financing form of initial coin offerings.

The main (theoretical) interest of ICOs was the universal, unregulated and global access to a new form of exchange and investment in technologies, which is now gradually being replaced by a new form close to a “light” version of the traditional IPOs operated by banks, the now-famous STOs.

But these STOs are not really an evolution of the maturity of ICOs, but rather a return to something that already exists, which has been somewhat modernized. We have gone from the pen to the ballpoint pen, but the principle remains similar to the cuneiforms on clay tablets.

STO is not a grandiose revolution; at best, it is the official acceptance and appropriation of the Blockchain by the established financial sector. This is already great progress if we compare it with what was said not so long ago.

Conclusion

Taking into consideration all the abovementioned points, it is possible to get a clear understanding of ICO and STO. Both can benefit from the Blockchain technology allowing total automation, transparency, and immutability of transactions (purchase, sale, or exchange). This technology, which is independent of regulatory authorities, banks, and intermediaries such as stockbrokers, notaries, and lawyers, confirms these various advances for ICOs. STOs, on the other hand, insofar as they are regulated, remain dependent on public regulatory bodies and, to a certain extent, on banks.

Participatory finance is about to get better with the more secure and regulated approach offered through STOs.

My name is Sardar Ayaz a professional content writer and SEO expert having Proven record of excellent writing demonstrated in a professional portfolio Impeccable grasp of the English language, including idioms and current trends in slang and expressions. I have ability to work independently with little or no daily supervision with strong interpersonal skills and willingness to communicate with clients, colleagues, and management.

I can produce well-researched content for publication online and in print, organize writing schedules to complete drafts of content or finished projects within deadlines. I have 12 years’ experience to develop related content for multiple platforms, such as websites, email marketing, product descriptions, videos, and blogs.

I use search engine optimization (SEO) strategies in writing to maximize the online visibility of a website in search results